Turn Your Equity Into Income with Fast ADU Funding

Finance your ADU in 5 days — no refinance required. Keep your first mortgage intact and unlock your property’s potential with our quick, flexible second mortgage solutions tailored for California homeowners.

Trusted by California Homeowners Statewide

Join over 1,000 homeowners who secured fast, flexible ADU funding with no refinance needed

How Our Fast ADU Financing Works

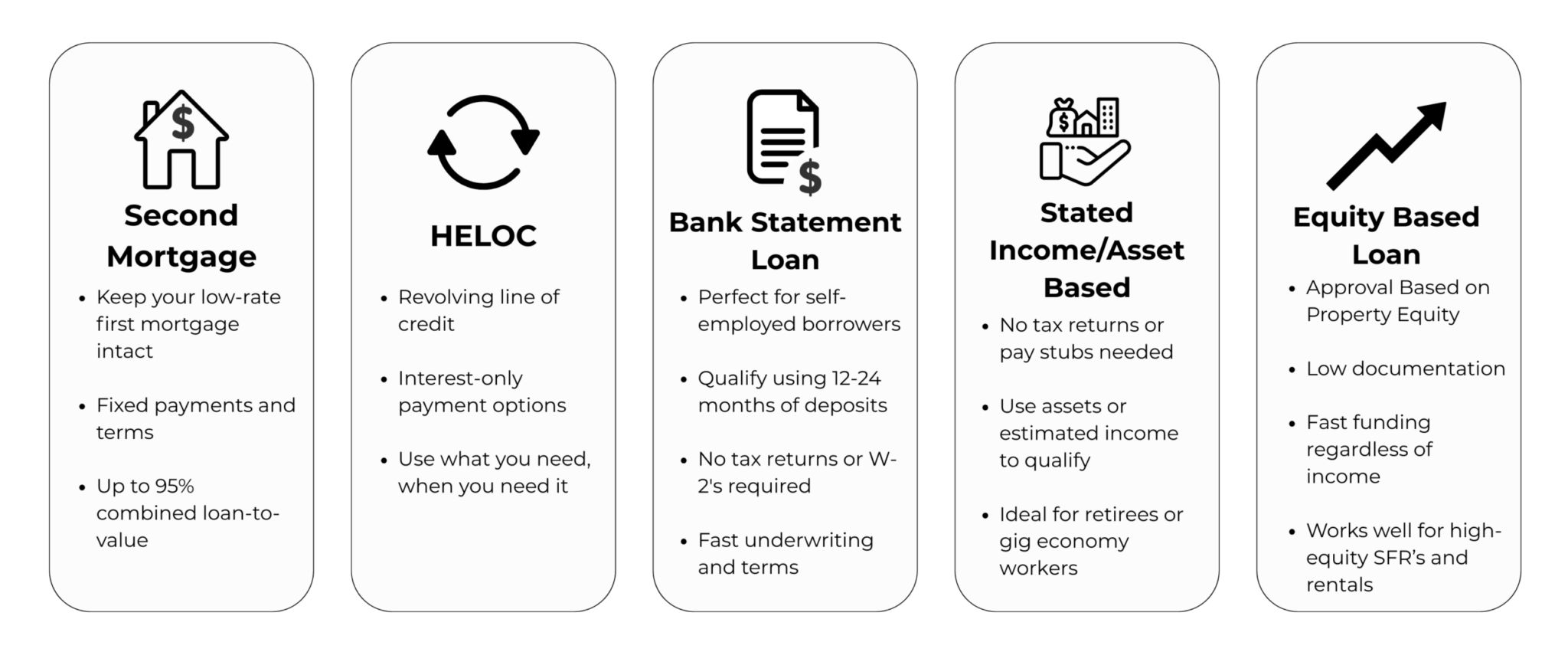

Explore Your ADU Loan Options

Whether you’re a W-2 employee, self-employed, or retired — we have flexible financing made for California homeowners

See If You Qualify for ADU Financing in 60 Seconds

No credit check. No obligation. Just a few simple questions

Built for California Property Owners Like You - Popular ADU Uses

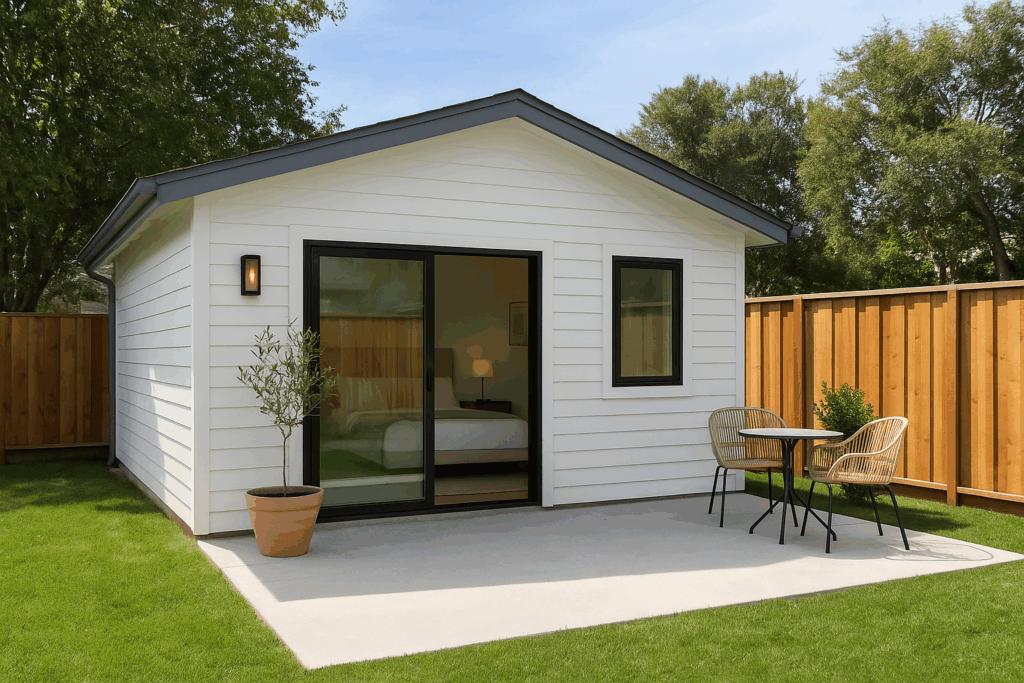

Detached One-Bedroom ADU

The most versatile and popular choice.

Great for rentals, in-laws, or extra living space — usually 400–800 sq ft with full kitchen and bath.

Garage Conversion ADU

Affordable and space-smart.

Turns an existing garage into a cozy rental or family unit with minimal construction cost.

Attached Studio / Jr. ADU

Built into or onto your main home.

Ideal for guests, adult kids, or a private workspace — easier permits and utility tie-ins.

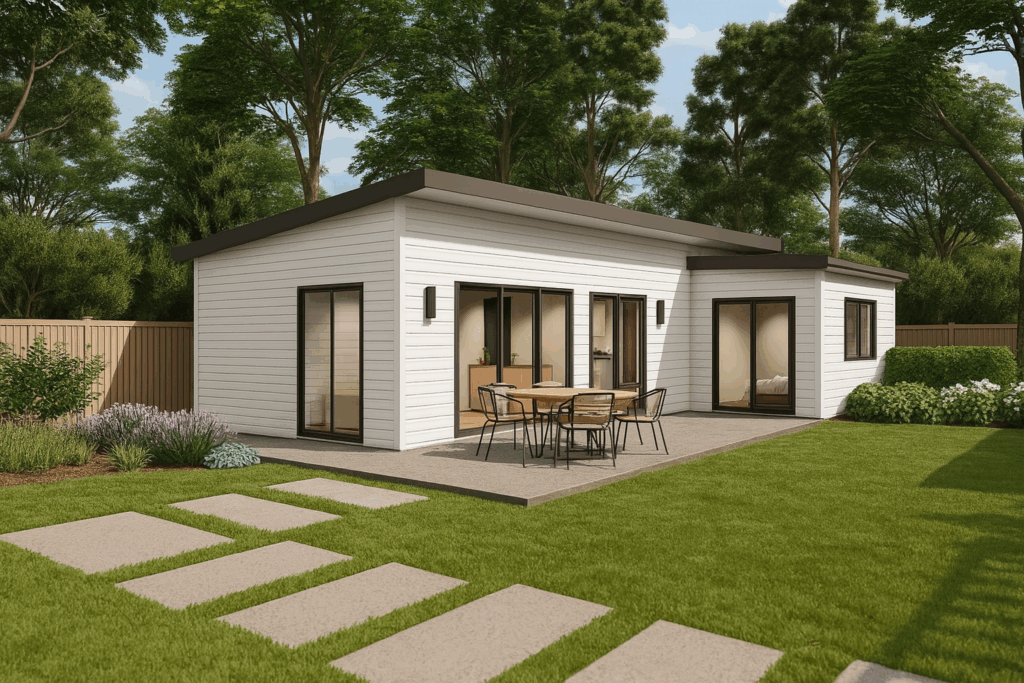

Two-Bedroom Detached ADU

Maximum space and rental income.

Perfect for families or long-term tenants looking for a full-sized living experience in your backyard.

Luxury Short-Term Rental ADU

Designed to impress and earn.

High-end finishes, private patio, and great for AirBnB (where allowed) — ideal in tourist-friendly zones.

ADA-Friendly Senior Unit

Built for aging in place.

Single-level design with accessibility features like wide doors and roll-in showers for elderly or mobility-limited family.

ADU Financing FAQs

What is an ADU loan?

An ADU loan helps you finance the construction or conversion of an Accessory Dwelling Unit (ADU) — like a rental unit, in-law suite, or office — without refinancing your primary mortgage.

Do I have to refinance my current mortgage?

No — most of our loan options are second mortgages, so you can keep your low-rate first mortgage untouched.

How much can I borrow?

Loan amounts typically range from $50,000 to $500,000 depending on your equity, credit, and project scope.

What do I need to qualify?

You’ll need decent equity, basic credit, and property ownership in California. We offer loan options for W-2 employees, self-employed, retirees, and more.

Does this affect my credit score?

Our pre-approval process uses a soft credit check — no impact on your score.

Can I qualify if I’m self-employed?

Yes. We offer bank statement and stated income loans specifically designed for self-employed borrowers.